In recent years, we have witnessed a restructuring of the banking sector that has caused the closure of a large number of branches. To try to solve the closing of offices, banks have substantially improved the number of functions that applications offer us for mobile devices.

But also, taking advantage of technological advances in recent years, companies have appeared that are presented as an alternative solution to traditional banking, companies that offer us most of the services of banks, but with a greater variety. Bnext is one of them, a company that offers us a (counter) current account on our Smartphone and that gives us 10 euros when activating the card they send you for free after depositing a balance of 25 €. And if you invite a friend and they sign up, you will both receive an additional € 10.

But what is Bnext?

Bnext not only offers us the alternative to traditional banking as we know it today, but also, complies with all the legal requirements and is regulated by the Bank of Spain, which allows you to create accounts and issue associated cards with which we can pay and withdraw money in any country in the world.

Through the Bnext application for iOS and Android mobile devices, we have at our disposal everything related to our bank account, and with which we can carry out any type of management quickly and easily. In addition, when opening the account, we also have a prepaid card at our disposal, with which we can make payments at any store and withdraw money from any ATM for free.

If when withdrawing money from an ATM, it applies a commission to us, Bnext will be in charge of paying it back to our account. Another advantage it offers us is the total absence of commissions and without demanding conditions, something that banks cannot renounce, at least they affirm, unless we have associated another product contracted with the entity.

What does Bnext offer me?

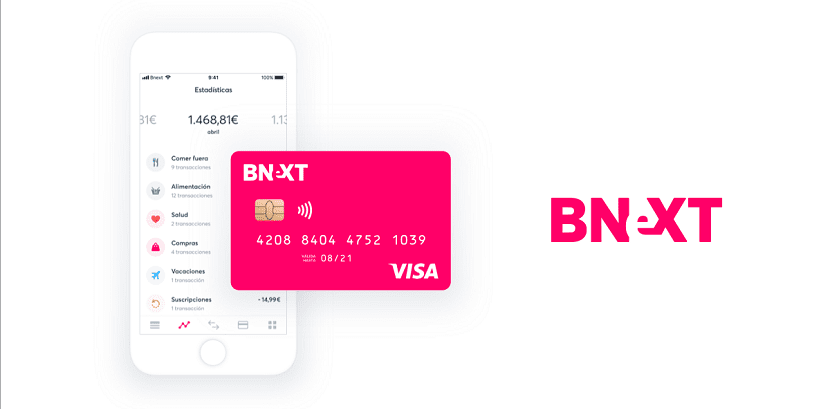

When opening an account on Bnext, we must request a card to operate with the account. So that we can check the advantages that Bnext offers us, we must previously add 25 euros in the form of a balance. That money will be available on our card, not being the cost of issuing the card as usually happens in traditional banking.

As I mentioned above, if we usually travel, the service that Bnext offers us can come in handy, since it also allows us to withdraw money or make payments without any type of commission and with the best currency exchange of the moment. Thanks to Bnext we can go with just cash and make all kinds of purchases with our card.

As if that were not enough, it allows us send or receive money from our friends, an ideal function for when the group of people you are part of has to buy a gift together, prepare a meal, go on a trip ... so that the excuse I don't have it loose o I spend tonight when I get off work no longer valid.

Personalized customer service is another of the strengths that Bnext offers us, since it allows us to get in touch with them through a direct chat, without having to be glued to the phone waiting for the speech to disappear all operators are busy.

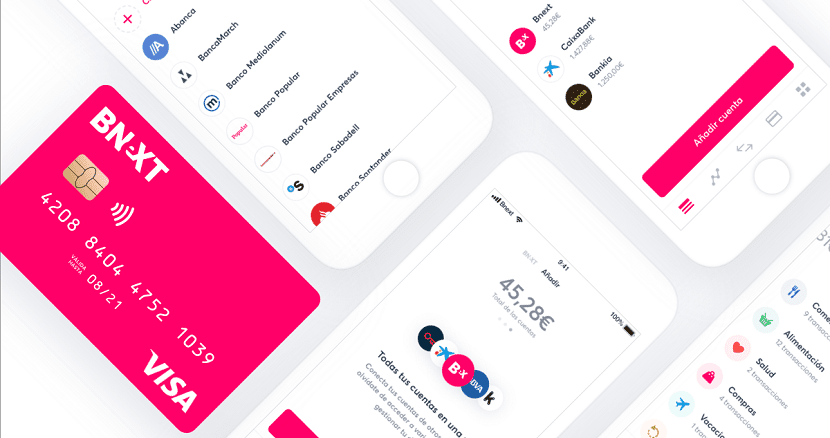

Another advantage that Bnext offers us is the possibility of being able to access our traditional banks Through the application, a function that will avoid us having to go through a continuous round of all the applications every time we want to see the available balance, the payments made ...

How much does Bnext cost?

As I have commented above, Bnext offers us a totally free service, without any type of commission and a versatility that we will hardly be able to find in traditional banks. In addition, if we want to take advantage of the launch of the application renewal, we can take 10 euros of balance completely free for our card.

10 euros free for opening an account at Bnext

If you are already a Bnext user, you will not be able to enjoy this promotion. However, if you think that it is time to switch to fully digital banksAt least in part, thanks to the promotion offered by Bnext, we can get 10 euros, 10 euros that will be added to the balance of our card and that we will be able to spend on whatever we want.

Those 10 euros, will be added to the 25 euros that we must add to the card When we create the account and request it, 25 euros, which, as I have mentioned above, does not correspond to the cost of issuance, but is necessary to be able to use the card in any type of shop, ATM or online service.

To take advantage of this offer that Bnext makes available to readers of Soy de Mac, you just have to visit the Bnext website or download its app from this link.

In addition, now you can invite your friends and family, so that if any of them register and activate their card, each one will receive an additional € 10. That is, in total you can earn € 20 by activating your Bnext card.

Application Bnext for mobile devices, is available for both iOS and Android and already has a base of more than 90.000 active users. Do you dare to try it?

Hello! We are delighted that you can enjoy our new app. If you have any questions or want to know more about us, we are here to answer you

Can you link it to Apple Pay?