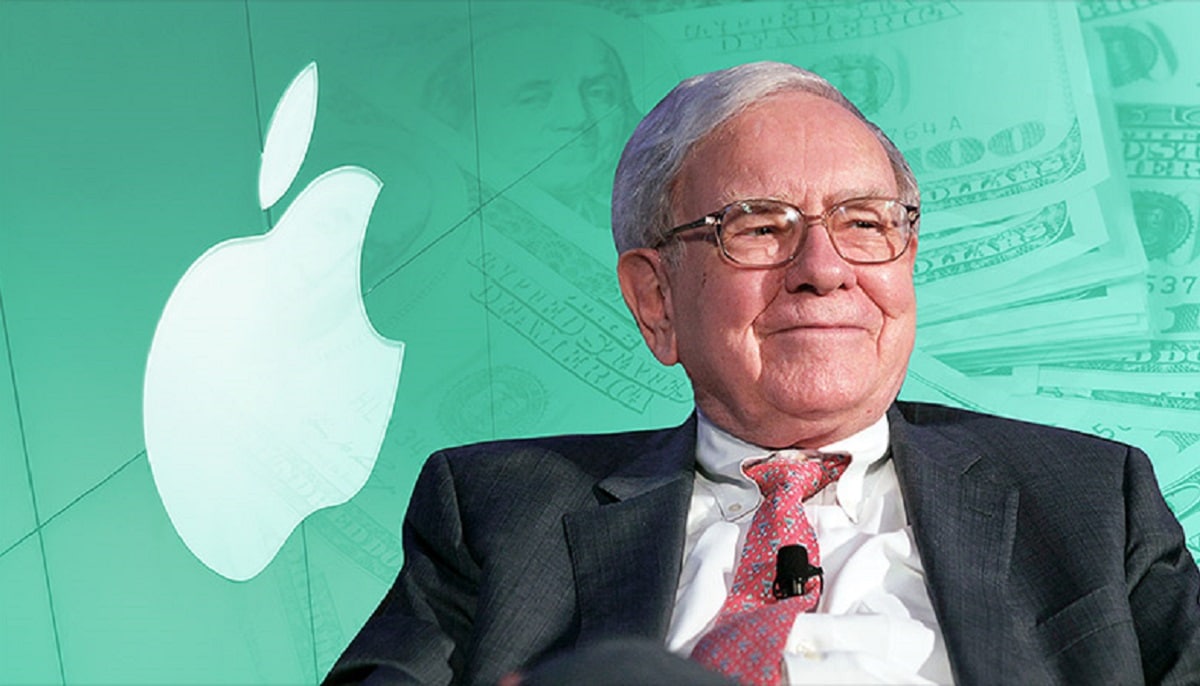

Warren Buffett, considered one of the great investors in the world, his fortune is incalculable and difficult to pronounce, he has a gift to turn all his actions into success based on hard work. For many years, this true influencer resisted buying Apple shares, because according to him, "he did not understand the technology company." However he now owns many millions that have made Berkshire reaches record numbers

We always talk about Apple's success and how much money its shares have made. In fact there is talk of the three trillion dollar company as a milestone that will eventually be achieved, thus being the first to achieve it. However we forget all those people Apple is making richThanks precisely to those increases in the value of their shares.

Berkshire or Warren Buffett is not one of those people who have become rich thanks to the Californian company, because they already were and a lot. But it is true that they have managed to increase profits much more. Berkshire began acquiring Apple shares in late 2016, and currently owns shares worth $ 120.000 billion, at a cost of $ 31.100 billion. In statements by Buffett himself:

Berkshire's investment in Apple vividly illustrates the power of buybacks. We started buying Apple shares in late 2016 and in early July 2018, we owned just over 2018 billion Apple shares (adjusted for fraction). When we finished our purchases in mid-5,2, Berkshire's general account owned 775% of Apple. Since then, both companies have enjoyed regular dividends, averaging about $ 2020 million annually. In 11.000 we have pocketed an additional $ XNUMX billion by selling a small part of our position. Berkshire now owns 5,4% of Apple.

Buffett resisted buying Apple shares for years because he said he didn't understand the tech company. Working with investment MPs Todd Combs and Ted Weschler, however, Berkshire expanded and has since added other tech companies such as Amazon and Verizon as well. Apple is now one of Berkshire's three most valuable assets, aligned with its insurers and the BNSF Railway.